Artificial intelligence has revolutionized the thought process of companies and consumers and brought them to the same demand: an easy yet secure way to manage their finances. Fintech companies are aware that the benefits of AI in Finance can directly have a positive impact on their growth. Undoubtedly, AI-driven solutions will accelerate technological advancement in various finance-related processes. It will also increase user acceptance and shift the common framework to enhance their versions.

Through this blog, we will discuss the major benefits of AI in finance industry, along with some other crucial topics showcasing changes that AI has brought to this industry.

To begin, we must understand the most basic yet significant question you should know as readers of this blog:

There are different answers to this question, and one can customize their response as per the benefits they wish to drag out by using specific AI features. But to put us all to a common start, the financial processes such as data verification, reporting, data collection, and many others were dependent on human resources and consumed lots of time. All these manual activities made the entire financial process slow and costly. But with AI integration with the financial industry, companies can easily standardize their financial operations. AI has made the finance and banking industry capable of handling complex scenarios by offering them coverage through their features. There are multiple benefits that AI-based solutions have offered the finance industry. Before discussing the perks AI offers to finance companies, let us explore various sections within the finance industry. It can help understand the application of AI-driven solutions in different aspects of the finance sector. Here you can witness three major divisions within the financial industry where AI algorithms are implemented to handle the various financial processes. One of the important business advantages that AI in Finance offers is its ability to prevent cyberattacks and fraud. Consumers always demand that banks or other financial services provide security to their accounts. Digital processes such as online payment require assurance against any fraud. AI can offer high-quality protection to these sections by analyzing the irregularities in the patterns that can go unnoticed by humans. Finance AI solutions are very helpful in managing corporate financial processes. It helps in assessing as well as predicting the loan risks in a better way. Companies wishing to enhance their value can always trust AI-based technologies such as Machine learning for reducing financial risk and improving loan underwriting. With AI’s advanced fraud detection feature, corporates can control financial crime by spotting unusual activities. Also Read: Machine Learning in Finance Industry Financial independence is a demand of this era; every individual wishes to have the ability to manage their financial health. All they want is a supporting force from behind as assurance that the processes they are operating are going in the right direction. Via chatbots powered by NLP, the AI in the fintech industry offers this 24*7 financial guidance to any individual. These AI-driven chatbots provide the answers to queries. Let us unveil the perks that AI adds to the finance industry: AI-driven financial solutions can improve the understanding of the business performance of entire teams working at different levels by offering data clarity. It can also give a positive direction to the workforce planning to identify and work on the areas that can be profitable for the organization. A creative, competitive differentiation from assessing the talent gaps and other vital components responsible for organizations’ growth can be created using features of AI. All of this, in a nutshell, will work to improve the business value. AI development services adapted by organizations can offer them accuracy within various vital processes. With the help of AI-driven solutions, the dependence on human resources is decreased. Thus, the chances of errors in different approaches are also reduced, as AI offers error-free automated tasks. The forecast, modeling, and planning of additional financial calculations are also improved, providing accuracy with various predictions such as sales forecast, revenue collection, etc. One of the most significant benefits of AI in Finance is its ability to enhance the organization’s productivity at different levels. It’s because AI has features that support faster data analysis and reduce the time required for producing statutory reports. With AI technology merging with the finance sector, employee productivity is also increased as different processes will not require useless hard work and can be completed using artificial intelligence. AI in Fintech market can do wonders by assessing risks that the organization can go through. For instance, knowing whether someone is eligible for a loan or not is very important, and banks or fintech companies can use AI-based machine learning algorithms to determine the eligibility required to pass the loan. The best part is that AI is not biased toward any system, which means the determinations can be trusted as it is accurate. Not just the assessment but the risk management also becomes easy with the AI. Also Read: How is AI Beneficial in Risk Management? The AI in Finance has protected the finance and banking industry against fraud. The AI-driven solution can help them detect unusual patterns within their processes, which catches the frauds. It is not just detection but AI also supports fraud management, which can analyze each step of different methods enrolled within financial organizations. For example, you would have heard credit card companies call after several purchases are made using the card. It is because they receive an unusual signal of buying behavior that triggers them and makes them inform the cardholder that alerts them. Chatbots driven by AI technology have helped multiple fintech companies to grow. With these benefits of AI in Finance, the customer receives 24*7 guidance for their queries. With the virtual assistant and chatbots, the customers do not have to wait to get clarity about their doubts. This feature of AI can level customer satisfaction in the finance industry. It is due to AI that, within the minimum effort, the best can be customized to ensure the good utilization of time for being productive and supports the organization’s growth. It is quite understood that data plays a vital role in driving the direction of any decision taken. Various aspects of financial processes need to be analyzed to drag out accurate data. It can be hectic when done manually, but with finance AI solutions, it becomes easy to track, monitor, and analyze the data, which can further be used to enhance the decisions. When you study carefully, it can be seen that every benefit AI adds to the finance industry supports the fact that it saves money. When the processes that can take up to 10 or more employees to work on are completed by automation that AI offers, it is a boon for the company. Hiring costs and training costs can also be saved. Also, it frees the employees to shift their attention towards other core activities supporting the company’s growth. Digitalization has introduced various applications supporting financial activities, such as online payment applications. These carry vital information about the consumer and the organization, which must be protected. AI in Finance can remove the stress of managing the security of such applications. It is estimated in the survey that more than 90% of cloud breaches occur due to human error, which is covered when artificial intelligence is used as it boosts the security of the company. The financial industry trends keep changing and upgrading with technology. It is essential to follow these trends to offer the best services and stand above competitors. Artificial intelligence can be used to understand the frequent changes that occur within the industry. It makes adapting to these changes easy and beneficial for the company and its customers. The points mentioned above would have let you explore every possibility that brings Finance and AI closer. It’s not just fintech; artificial intelligence has set itself as vital integration in almost every industry. The pandemic has broadened the tough process for companies as well as consumers. They need a solution that can make human integration with financial companies easier. It has been anticipated that in coming years, integrating AI- driven fintech software development will help to enhance several financial processes by making them streamlined and analyzing the relevant data much faster than humans. It will not be wrong to say that the core banking and financial industry, along with the finance departments of different industries, will soon be adapting AI-driven solutions for their growth. What is AI in Finance?

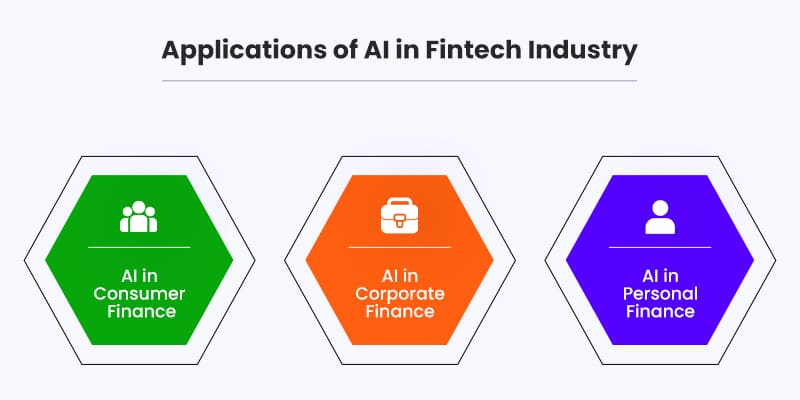

Applications of AI in Fintech Industry

1. AI in Consumer Finance

2. AI in Corporate Finance

3. AI in Personal Finance

Benefits of AI in Finance Industry

1. Enhance Business Value

2. Offers Accuracy

3. Improves Productivity

4. Best With Risk Assessment

5. Offers Fraud Detection

6. 24*7 Customer Interaction

7. Improves Decision Making

8. Saves Money

9. Offer High-Quality Security

10. Keep the Services Updated

Future of AI in Finance