The peer-to-peer (P2P) payment industry has seen a rapid rise in popularity in the last couple of years. In 2020, the global P2P payment market was valued at $1,889.16 billion. Furthermore, it is projected to hit the $9,097.06 billion mark at a CAGR of 17.3% between 2021-2030.

This massive surge in the acceptance of digital banking methods such as P2P payment, eWallets, etc., can be accredited to the rise of smartphones. It also helps that the driving force behind this industry is Millennials, who tend to employ their smartphones for their every need. Digital payment methods such as P2P bring about a level of ease to transactions unlike any other. Instead of spending precious hours at a bank, people can simply use these methods to transfer money from their mobile phones.

We live in an age of ultra-ease where everything has been streamlined and connected to the internet, including our bank accounts. With the help of cutting-edge security measures, digital payment vendors safeguard every transaction.

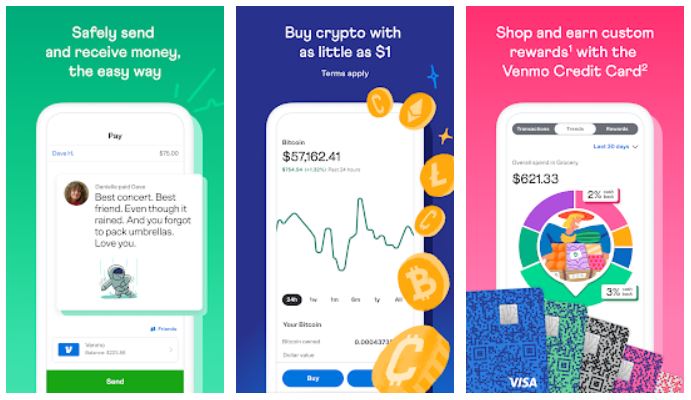

Some of the top P2P apps are Google Wallet, Square Cash, and Venmo. And in today’s blog, we will see how you can develop a P2P mobile app of your own.

What is a P2P payment and how do they even work?

Image Source

Image Source

P2P payment is the transfer of money from one person’s bank account to another’s directly over the internet. Usually, this service is provided by a third-party app that asks you to add your bank account to its database. These apps ensure that all your critical data is safely stored using many cryptographic and other such technologies.

Once you have added your bank account to these apps, you can send money to another person’s bank account or request money from them.

There are several reasons why people prefer using P2P payment these days over traditional methods:

- P2P payments are almost instantaneous. The biggest shortcoming of traditional methods is that the transfer can take time, anywhere between a couple of hours to days. But P2P payment takes this delay out of the equation. So people who are in immediate need of money can have it with a couple of taps and swipes.

- Payment automation systems make P2P payments way easier to make. Unlike traditional bank transfers, you are not required to be in a bank for hours, dealing with interminable lines and countless formalities. Usually, bank work takes hours out of a person’s day, but with P2P and payment automation systems, transferring money barely takes a few minutes.

- People are very cautious about bank accounts, as they should be. So if they are trusting to use these apps and are giving them access to their bank account details, they are showing enough faith in their safeguards. Thanks to the strides P2P payment apps have made and the countless regulations they have to follow, every payment made through these apps is as safe as it can be. That doesn’t mean there are never any data breaches, but things have certainly improved, considering where the industry was a couple of years ago.

What makes Venmo so special?

Out of all the P2P payment apps, Venmo possesses the biggest market share. Why? Because it’s easy to use, secure, and much more than simply an app that lets you send money to other people.

Founded in 2009, Venmo is an American mobile payment service. It gained popularity when Braintree, a mobile and web service payment provider, bought it in 2012. Then, in 2013, Braintree was bought by PayPal, and by extension, Venmo became a subsidiary of PayPal, which did wonders for its popularity.

What made Venmo such a big deal at the time was the ease that it offered to its users. Not only did it allow users to cut out the waiting period between the money transfer app and reception, but also it made it so much easier for people to make those transfers. It also helped that it came out just when the smartphone market began to take off.

At the end of 2020, Venmo had about 52 million users, and its annual payment volume was $159 billion. Furthermore, Venmo generated $450 million in revenue in 2020, and PayPal projects that Venmo will generate $900 million in 2021.

How to develop a P2P payment app like Venmo?

The numbers clearly show that the P2P payment industry is one of the most profitable ones at the moment. But it is far from being saturated. The digital payment industry as a whole is projected to grow many folds in the next few years, and if you are looking to develop a P2P payment platform of your own, then we have created a guide for you to follow.

Mobile app development is a difficult endeavor with many hidden pitfalls. And small or new startups face many challenges as they are trying to get their business off the ground. So, teaming with a mobile app developer who has experience creating digital payment platforms such as a P2P payment app, is a smart move.

Of course, you can hire a team of experienced mobile app developers and make the app yourself. But this is an expensive and tough route to go on, especially in the very beginning. Hiring an entire development staff costs money, and so does installing and then maintaining infrastructure. The amount of investment is big, and not many startups can afford it, not in the beginning or till they find some big investors.

This is where MVPs come in. MVPs, or minimum viable products, are leaner versions of the main app. These apps only have the core features, but they are implemented and polished to perfection. These MVPs help startups create buzz for their apps in the market even before the full version is released, bringing in new investors.

Many startups these days hire mobile app developers to develop MVPs for their apps. There are many great mobile app development firms with good experience in developing digital payment platforms.

Research and Strategize

The first step in every mobile app development is getting the lay of the land. You can’t dive headfirst into the market thinking you will figure things out as you go. No, mobile app development is a risky business, and if you’re not careful and don’t have a game plan, you will lose money.

So, before anything, study the market. Analyze your competitors and see what they are doing right. You can conduct one-on-one interviews with users to figure out what they want in an app like this. The goal is to figure out why they would abandon an app like Google Wallet and Venmo and come to you. The answer is in the services they don’t provide or don’t provide very well. Their shortcomings will be your selling point and will help you define the hook of your app.

Once you have studied the market, it’s time to strategize. You need to figure out your budget, the technologies you will use, etc. This part of the process is best done with mobile app developers and banking experts. They can help you finalize the details and provide crucial insights about the technologies you should use and the compliance issues you will deal with. Hiring an experienced digital platform developer will also help you avoid the many mistakes newcomers in the market usually make.

Create an MVP

Now that you have a developer, it is time to create an MVP for your app. If you are trying to create an app like Venmo, you need to implement the core features of your app in your MVP.

Given below is a list of some of the feature that should be included in your MVP according to Matellio’s experts:

You will have to allow users to add their bank account/debit card details to your apps. Furthermore, you will have to let users add friends or people from their contact list to the app. It will also help if you let people go beyond their contact list and add friends from their Facebook friends list as well. While implementing the P2P money transfer feature, make sure you adhere to the federal bank norms.

Enhance and Test

Once you have built your MVP, you can use it in several ways. You can release it to the general public. If the app is good enough and the reviews are good, you’ll know that you’re on the right track. But if the reviews are not so great, then you can go back to the drawing board and rework.

The best thing about building an MVP is that it costs less than developing a full-fledged app. So if there are some flaws in the concepts and features of your app, then you don’t end up investing heavily in it. Instead, you test it by making it available to the users and rework. This way, you ensure that your app comes out in the best possible state.

MVP can also be used to get more investors. Some investors like to see a working product and a plan before writing you that check. Others are attracted to your app when it gains popularity. In both cases, your MVP is crucial.

After MVP comes enhancement, you need to add all the other features that an app like Venmo should have, like social features, cryptocurrency wallet, eWallet, etc. The best part is, you don’t have to build your app from the ground up; you can enhance your MVP. This way, you are saving time, and you are saving money.

Once your app has been developed, it is time to test it rigorously. If you release a buggy app in the market, it will destroy your reputation. People these days expect quality, and by releasing an untested app, you are scaring away many customers.

Deploy, Maintain, and Update

After thoroughly testing your app and ironing out all the UI/UX minor kinks, it’s time to deploy your app. You can make it available on one or multiple smartphone app stores based on your business plan. Google Play Store and Apple Appstore are two of the biggest marketplaces for smartphone apps, so make sure your P2P payment app is available on both platforms.

After deployment comes maintenance. You need to be quick about releasing patches and providing bug fixes. Furthermore, people don’t shy away from leaving things about your apps that they don’t like in the comments section of your app store page. So make sure you respond to those comments and fix all the technical issues.

Lastly comes the updates. Mobile app development is not a one-time process. After the initial release, you need to provide your users with new reasons to use your app. Market changes too quickly these days, and you need to stay on top of current trends to stay relevant.

Read More: Discover how partnering with a P2P lending platform development company can revolutionize your fintech business by streamlining lending processes and enhancing user experiences.

Conclusion

P2P payment transfer apps enable individuals and businesses across the globe to make real-time payments over the internet. The ease with which people can now make substantial payments is almost uncanny and seeing how people have embraced it, this sector is likely to grow even more. There is plenty of room to expand and innovate in this sector, and new startups are coming with radical and innovative ideas to take this industry into the future.

If you are one such startup looking to revolutionize the digital payment industry with your app idea, then Matellio is the right app development partner for you. With years of experience, Matellio understands the care it takes to deliver a technologically sound mobile app that is easy to use and adds value to the clients. Our talented mobile app developers and digital payment experts help our clients polish their ideas and provide crucial insights that help them improve their apps. Thanks to our client-centric and Agile development approach, our clients are always at the center, and we make sure to always keep them in the loop. We respect our client’s vision, and our deep talent set allows us to be the quarterback of their mobile app development teams.

If you want to hire a cost-effective P2P mobile app developer, contact us today!